Brussels’s Achilles Heel

Greece has been a migraine for Brussels since the onset of the financial crisis but it became a very inconvenient headache with the recent election of the Syriza party led radical left wing government of Alexis Tsipras. Until now Greece had been the poster child of the structural problems of the EU currency union but it is now the poster child of radical political populism as well. How have we come to this?

On the financial level, Greeks have no one to blame but themselves. When the euro (€) was created it endowed all EU member states with a currency backed by German reputation. If financial management elsewhere in Europe had paralleled that of Berlin’s – highly inflation averse and fiscally conservative – all would have been well but because mentalities differ according to nation in Europe, the priorities of politicians also differ in expediency.

Hosting international sports competitions for instance, is a luxury that few can afford but whereas Germans or Dutch, with much bigger economies, would do so in a time of economic growth, in 2004 during a time of economic stagnation, the small economy of Portugal hosted the European soccer competition (with 10 new or renovated stadiums) and equally small Greece hosted the Olympics.

Another interesting example is the South’s real-estate bubble. Politicians encouraged the youth and lower classes to purchase property since that was the fulfillment of many a socialist’s dream. Historically low interest rates, brought about by the EU’s single currency, provided the opportunity. Politicians provided the incentive by putting pressure on the banking system to take risks in this regard. In small economies, the number of banks is limited and their ties to politics abound since they are usually a family operation, hence requiring political connections to make it big. In more northern industrialized economies, the multinational nature of the banking institutions voids them of nepotistic traits by opening them to international scrutiny. On the other hand, it also exposes them more to international financial crashes – the 2008 US crisis didn’t much affect smaller economies in southern Europe and the Middle East until northern credit and tourists dried up.

Because self-reliance is not the European South’s prime commodity, people have come to expect much from the state in the way of entitlements: education, healthcare and social security making up the bulk of public expenditure in the Mediterranean belt. The social-democratic model of northern Europe serves as paradigm but the North is highly industrialized and wealthy. For poor economies dependent on mostly agriculture, tourism and residual foreign direct investment (FDI) – attracted mostly by low wages – though, expecting the same resulting standards is asking too much from the state but it is outright unreasonable when one factors in the relative profligacy of corrupt politicians as well as ordinary tax-evasion schemes of the citizenry.

In a way, the political narrative also demanded it. Greece went through a civil war in the aftermath of World War II, with the communists on the losing side. Centrist politicians have a special burden to prove to the population that communism is not needed for prosperity and social well being. In Portugal, over 90% of its territory was abandoned by the post dictatorial regime between 1974-75 during the decolonization, with a million Portuguese displaced and most of those moving to Portugal. In return, the new democratic regime promised to have Portugal accede to the EU to guarantee prosperity.

Therefore, endowed with a strong currency, southern EU states began to rack up debt at record levels. Worse still, this debt served to hide the economic stagnation from the public and was therefore used for consumption rather than investment. In general, no politician wants to be the bearer of bad news but additionally, the more south one goes in the planet, the more politics resembles a rent-seeking scheme for parallel interests, with certain parts of Africa and Latin America going to a kleptocratic extreme.

It is the Greeks’ responsibility and theirs alone to manage their own budget and bear the consequences of their own actions. Some say that banks should not have lent irresponsibly and unsustainably but the banks not only depended on ECB and EU goodwill to operate in the single market, they all bought into the ‘German guarantee’. They were right to do so as indeed Germany and northern Europe did come to the rescue of the southern trouble-makers by making available loans at generous rates, at a time when the ‘PIGS’ were no longer able to finance themselves in the international lending markets. The price to pay was to enact budgetary reforms to ensure the problem would not repeat itself.

Both Greece and Portugal have been mentioned so far because this is where they parted ways: Portugal went on to enact austerity measures involving tax hikes and cuts in salaries – particularly painful cuts considering that the state apparatus in southern nations, invariably accounts, directly and indirectly, for about half of the GDP – but Greece dragged its feet. Austerity was implemented but not only were many of the intended targets not met, the debt had to undergo a ‘haircut’ and there was a public backlash which reflected, first in the threat of a Greek PM to hold a referendum on the deal with the IMF and European lenders, and now in the actual election of a government which promises to “end austerity”. The result is patently obvious: in the same EU finance ministers Council of February, where the Greeks tried to renegotiate the conditions of their loans, the Portuguese instead asked to be authorized to repay their loans from the IMF early, and thus save half a billion euros in the process.

At this point, it is important to make a distinction between accounting and development. There are many paths to development, many economic models one can follow, depending on the conditions of the economy in question: some states become tax havens, others tax heavily; some are transit hubs and others are export economies; some depend on natural resources, some on competitive labor force. Development models are not universal but mathematics is; no human culture has ever, in the history of Mankind, been able to spend more than it produces. From the most high-tech society in the northern hemisphere, to the most traditional tribe in a southern rainforest, accounting obeys the same rules of arithmetic. Mathematics really is the only universal language.

This must be understood because some on the Left have argued that Greece be allowed to relinquish austerity altogether. Utopians believe a Greek default would have no impact on the country’s reputation; somewhat less utopians want the EU to foot the bill, ignoring the so-called ‘moral hazard’ involved. They all argue for European unity though. Economists have pointed out that a currency union without a fiscal union is systematically dysfunctional. The European Left therefore argues that there should be systemic wealth transfers within the EU, from the most productive members to the most in need. This would reproduce the US system where impoverished US southern states, obtain proportionately higher federal funds, than their northern counterparts.

There are two problems with this proposition.

Firstly, the impoverished countries already receive higher EU budget transfers. The ‘cohesion funds’ serve to finance member-states struggling to reach average EU development standards, ‘accession funds’ sponsored the economies of – almost exclusively – impoverished states before they acceded to the EU, through the EU budget many non members of the euro currency area have been paying for members that actually possess the strong currency and the EU rescue package for the PIGS was predominantly a northern transfer of wealth to the south. This state of affairs makes one wonder what would change with additional transfers, and perhaps more importantly, whether such a ‘solution’ would not be …artificial.

Secondly, the problem runs much deeper in structural terms. Cultural individualism prevents EU statesmen from being open to discriminating between different societies, thus being condemned to trying to square a fundamentally imperfect circle. Brussels is the perfect storm in this aspect because technocratic economists operating under the assumption that individuals behave equally across borders, come together with politicians who must toe the euro-federalist line of an “ever closer union”. Brussels, like Washington D.C., is a micro-cosmos of EU dependent interests and all who live and work in the ‘EU bubble’ have a vested interest in transferring additional political competences to the EU.

The dynamic is such that national politicians, regularly meeting in Brussels to deal with EU matters, aspire to retiring from their national careers to a comfortable position in the Belgian capital. They are also influenced by the ‘groupthink’ that develops in a city where every solution offered by experts will deal with what they know best: the EU.

Then there are the ‘Eurocrats’. One of the basic principles of economics is ceteris paribus or ‘everything being equal’. Inhere lies a big problem for EU economic planning since different societies behave differently. How then to apply such common standards as the ‘Maastricht criteria’ – for acceptance into the Euro area – or the actual ‘Luxembourg criteria’ – for accession to the single market?

Deficit problems amounting from the introduction of the euro were not unknown to the EU and a number of policies had been attempted to address them, prior to the financial crisis. The ‘Stability and Growth Pact’ was one of these and envisaged 3% caps on annual budgetary deficits, with penalties to be paid by transgressors. It was dropped after Germany and France both broke the 3% cap. This too reveals much in the way of differences within the EU for the bigger the economy and the more central to the economic system, the less fragile it is to the moods of the markets. Germany and the US can actually afford to run high deficits or tax heavily because the size of their markets will always guarantee investment. Smaller economies like Greece need to value their reputation much more highly since the slightest hiccup can drive away FDI.

Apart from critical mass, there are inherent incompatibilities with the American model applied in Europe. Economist Robert Mundell wrote on ‘optimum currency areas’ and observed these required such factors as: labor mobility, free flow of capitals, similar business cycles and a risk sharing system in the likes of an automatic fiscal transfer mechanism. Not all of these are in place in the EU’s single market but even if they were, they would not overcome such basic differences as language or work ethics. The best economist in Greece cannot be recruited by a German bank unless he speaks German. More fundamentally, if sovereignty were to be removed from the equation, which state’s interests would ultimately drive a unified European federal interest? Whereas California and Texas bargained their adhesion to the Union without territorial subdivisions and were able to remain institutionally influential, most small EU members could never hope for the same.

Worse still, if the intention actually were to standardize culture within the EU and one were to choose to forget the obvious social engineering involved, who is to say that the German culture is the one that should serve as template? It is one thing for Texas and California to join the American Federation since these societies were already run by American elites and settled by Americans. It is another altogether to Germanefy or Nordicise entire nations. Nationalism was not born in Europe by accident.

The inconsistencies in Brussels policy and the faults of the Greeks aside, why did Greece so fundamentally underperform the other economies under austerity?

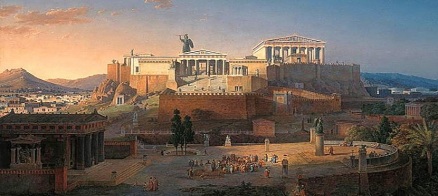

Europe is usually divided into three linguistic areas: the Germanic, the Latin and the Slavic. Perhaps in the case of Greece, it would be more useful to work with political theology and separate between protestant, catholic, orthodox and Islamic.

Italian historian Merio Scattola studied the differences between the models in what concerned the relationship between Church and State and found a line of gradation spanning from Mecca to Wittenberg regarding the preeminence of spiritual power. In Islam, the spiritual is zealously ritualized and religious authority is highly centralized. The Caliph rules the Ummah on behalf of the divine first and the temporal second. In Protestantism however, the believer’s connection to God is personal with rituals and symbols being seen as obstacles to devotion and communion with the divine. Political authority is merely political and even in monarchies, the role of the royal head of the Church is purely nominal. In between there is the catholic model where temporal and spiritual are parallel and the orthodox where they are melded. The line of gradation pertains to the individual’s role in the metaphysical: the more individualized the culture the more responsibility the individual assumes in his own salvation, the more collectivized the more the social hierarchy will assume competence.

Of course there are exceptions to every rule and no society is perfect, even in terms of financial management. Moreover, political leadership has a deep impact in financial policy and the human factor is unpredictable. Regardless, if there is a lesson to learn it is that there are limits to political and economic integration and that the EU’s “ever closer union” formula is in dire need of an overhaul.